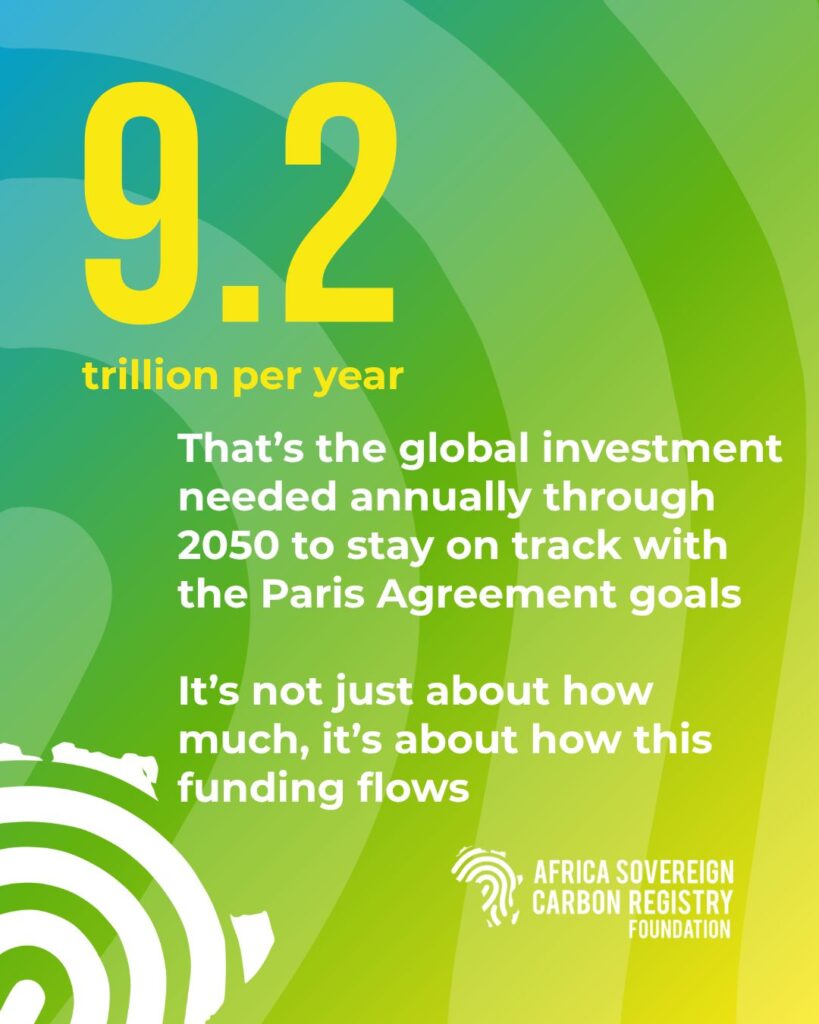

According to McKinsey & Company, reaching carbon neutrality by 2050 will require an average of $9.2 trillion in investments per year, or approximately 7.5% of global GDP. For African countries, the question is no longer just “how much?”, but rather “𝐡𝐨𝐰 𝐜𝐚𝐧 𝐰𝐞 𝐚𝐜𝐜𝐞𝐬𝐬 𝐭𝐡𝐢𝐬 𝐟𝐮𝐧𝐝𝐢𝐧𝐠 𝐢𝐧 𝐚 𝐟𝐚𝐢𝐫, 𝐭𝐫𝐚𝐧𝐬𝐩𝐚𝐫𝐞𝐧𝐭, 𝐚𝐧𝐝 𝐬𝐨𝐯𝐞𝐫𝐞𝐢𝐠𝐧 𝐰𝐚𝐲?” 💡

Article 6 of the Paris Agreement provides three mechanisms that allow countries to finance and cooperate, on a voluntary basis, in order to achieve more ambitious climate goals in their mitigation efforts:

➡️ Bilateral cooperative approaches (Article 6.2)

➡️ A centralized carbon market mechanism (Article 6.4)

➡️ Non-market approaches (Article 6.8), promoting climate action based on climate justice and national sovereignty.

This diversity of approaches offers complementarity with market-based solutions. From the European EU ETS 🇪🇺 to the systems implemented in China 🇨🇳, Türkiye 🇹🇷, and Brazil 🇧🇷, many states are structuring and strengthening their carbon markets to meet their objectives.

Africa is accelerating its transition thanks to numerous innovative initiatives and the development of new financing solutions.

Article 6.8 of the Paris Agreement specifically promotes a non-market approach increasingly adopted across the African continent, through the “Polluter Pays” principle.

The Sovereign Carbon Agency of Djibouti began its work in 2023, quickly followed by Gabon 🇬🇦, which launched its Sovereign Carbon Initiative in 2025.

These integrated and balanced non-market approaches make it possible to fulfill nationally determined contributions while ensuring sovereign economic revenue to finance the energy and climate transition.

As UNDP reminds us, the future of climate finance depends on strong governance, credible measurement systems, and an inclusive vision. This is precisely what the African sovereign carbon initiatives are building, paving the way for climate finance that is fair and tailored to the continent’s needs. 🌍